Aequi means equality in Latin and it’s symbol is ARBG.

Competitive Strengths Include:

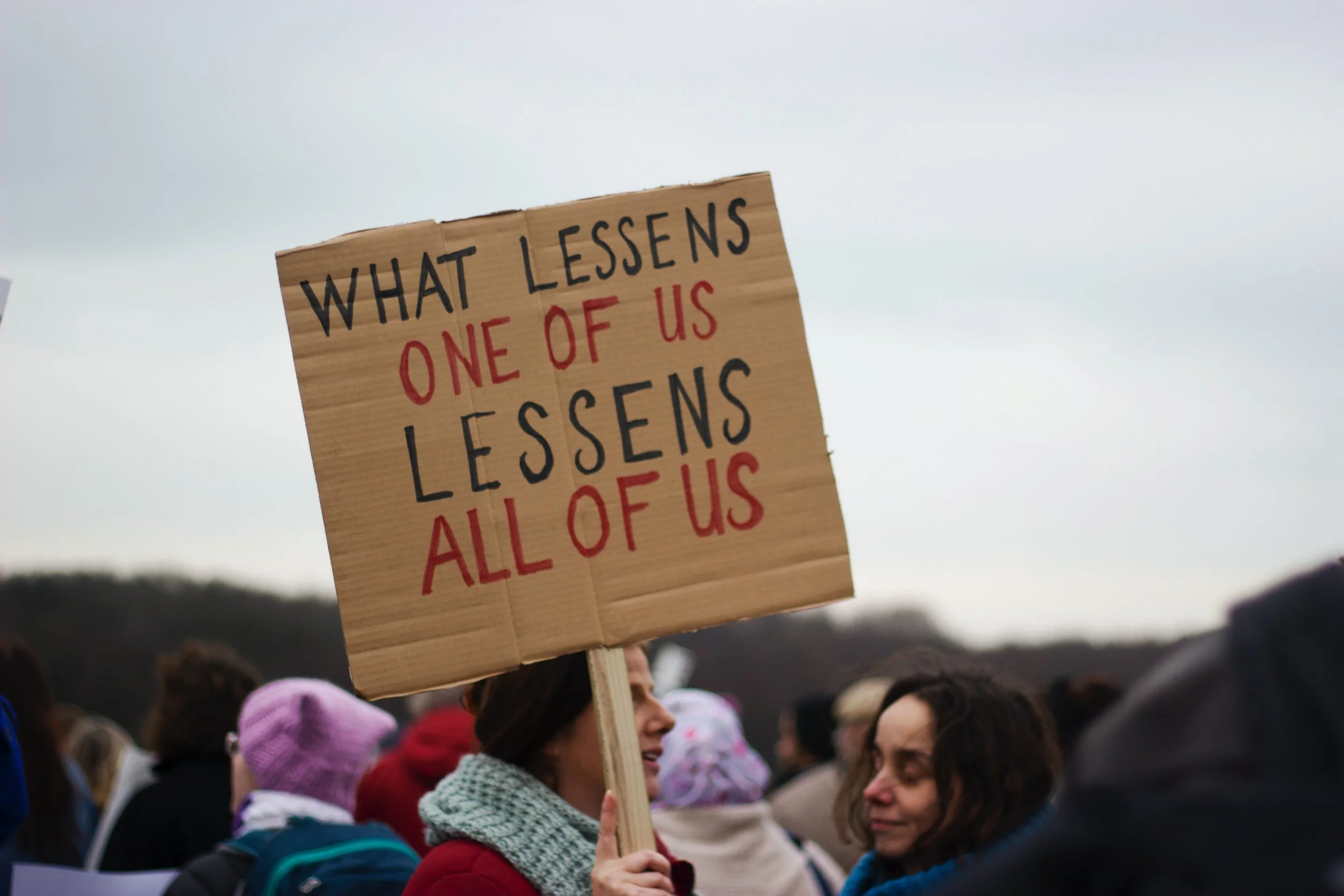

Focus on Diversity, Equity & Inclusion

We believe that our fully diverse board of directors uniquely understand and are able to advocate for the importance of DE&I as well as ESG principles as core levers for accelerating value creation.

Governance Experience

Our board of directors has extensive experience in corporate governance accelerating the focus on core ESG principles. In addition, they have taken companies public both as principal, advisor and corporate board member.

Deep Experience of the board of directors and Specialist Advisors

We believe that our ability to leverage the experience of our board of directors and Specialist Advisors, who comprise former senior operating executives of companies across multiple sectors and industries, will provide us a distinct advantage in being able to source, evaluate and consummate a compelling transaction on attractive

Execution & Structuring Capability

Our board of directors alongside our Specialist Advisors have a combined expertise and reputation that will allow us to source and complete transactions possessing structural attributes that create an attractive investment thesis. These types of transactions are typically complex and require creativity, industry knowledge and expertise, rigorous due diligence, and extensive negotiations and documentation.

Extensive Innovation, Technology and Data Expertise

We believe that our board of directors and our Specialist Advisors have extensive experience in understanding how technology drives businesses to capitalize on disruption and accelerate value creation.

Track Record of Accelerating Growth

Our board of directors alongside our Specialist Advisors have a proven track record of investing in businesses where they, along with their network, can accelerate growth.

Dedication to Culture & Purpose

Our board of directors has a deep commitment to purpose- driven organization culture and community engagement and demonstrated track records of creating and donating to positive systemic change. In addition, our sponsor is committing to donate 10% of the founder shares it holds to advance social and economic mobility following the consummation of the initial business combination.

Why Now?

Technology has continued to change consumer behavior. During times like COVID-19, that rate of change accelerates to meet changing demand. We believe that understanding the diverse needs of the consumer paired with what technologies like Data Science and Artificial Intelligence can accomplish to analyze those opportunities is the key to a successful consumer driven investment.

Consumer technology businesses are well poised for exponential growth and we believe that the overall sector represents an attractive target market given the size, breadth and prospects for growth. As of result of COVID-19, we have witnessed a generational change in the matter of months that we believe will continue to accelerate and provide transformational opportunities. We have not narrowed our business combination target to any particular consumer technology business, however, we intend to focus our efforts in areas where technology drives the consumer, such as: online retail, education, financial technologies, media & gaming, healthcare, wellness, legal, & procurement, fulfillment & eco-friendly packaging.